EV Salary Sacrifice: Your Questions Answered

Key insights:

Electric car salary sacrifice schemes allow employees to save 20-50% on EVs through pre-tax salary deductions while paying only a small Benefit-in-Kind tax (currently 2%), making premium electric vehicles significantly more affordable.

Employers offering EV salary sacrifice face minimal financial risk thanks to Complete Risk Protection, which safeguards companies from early termination fees due to redundancies, resignations, long-term sickness, or parental leave.

The scheme requires little administrative effort for employers, with providers handling most aspects, including vehicle ordering, documentation, and maintenance, while offering automated pay.

Salary sacrifice is a great employee benefit, especially if you can get an electric car for less, but it can be a daunting subject. Salary sacrifice refers to an agreement between employee and employer, where the employee agrees to give a portion of their salary (pre-tax) towards a specific benefit. This tax-free arrangement reduces both Income Tax and National Insurance Contributions, saving hundreds every month. Many things can be salary sacrificed, perhaps the most common is a Cycle-to-Work scheme, but you can also salary sacrifice your pension, childcare and even an electric car!

To help you understand green car salary sacrifice schemes, we've put together a list of frequently asked questions about electric car salary sacrifice. If you don't see your question covered here, don't worry! We have dedicated FAQ pages for both employees and employers to ensure all your concerns are addressed.

Let’s dive into the world of EV Salary Sacrifice!

Are Salary Sacrifice Savings Too Good to Be True?

In short, no. Salary sacrifice was introduced as a way for employees to add flexibility to their benefits package at no cost to the employer. As aforementioned, one of the most recognisable salary sacrifice schemes is the Cycle to Work Scheme which encourages employees to take up cycling.

The UK has committed that all new cars sold will be 100% electric by 2035. This is a result of our Net Zero target to reduce greenhouse gas emissions to zero by 2050. Therefore, the UK Government is offering incentives to help people make the switch from petrol or diesel to electric - The Electric Car Scheme is a great way to access these incentives. More policies implemented by the Government include:

Reducing public sector emissions by 50% by 2032 and 75% in 2037,

Making electricity cheaper to support industrial electrification and heat pumps,

Increase the number of publicly accessible charge points for EVs to 300,000 by 2030.

Although salary sacrifice is a great way to save money on the cost of an electric car, it’s not too good to be true!

The Most Common Employee Questions

Before entering into a salary sacrifice scheme, you must make sure it is the right decision for you. Here are some of the most common questions asked by employees considering an EV salary sacrifice scheme.

What Term and Mileage Can I Have On The Lease?

An electric car salary sacrifice scheme lease terms and mileage are similar to those of any other lease terms.

For an EV salary sacrifice scheme with The Electric Car Scheme, the agreement term must range between 12 and 48 months, with a maximum mileage allowance of 30,000 miles per annum. However, both the term length and mileage can be adjusted to suit your specific needs. Before placing your order, you’ll need to select the mileage you anticipate covering during the lease period.

This allows the lessor to do the financial calculation to take account of the impact of mileage on the second-hand value of the car when you return it to them at the end of the term. If you exceed the mileage the lessor will charge you for the additional mileage at a rate quoted to you on entering the lease.

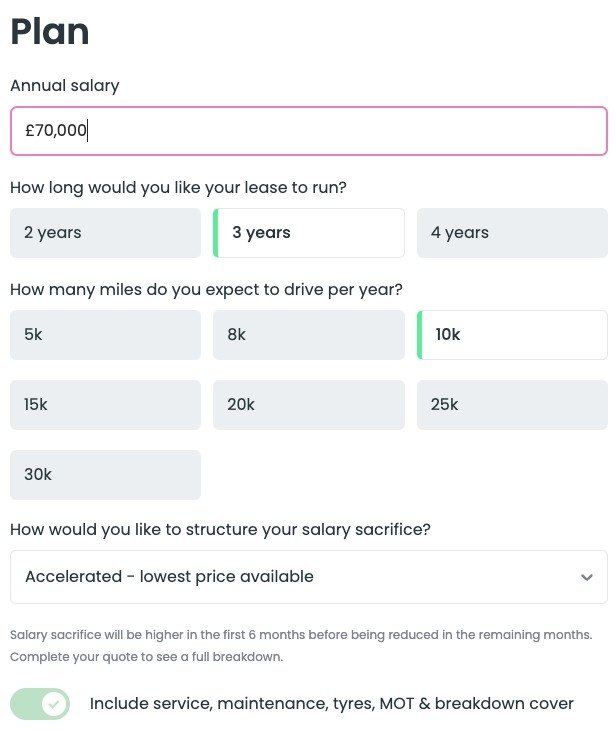

When you choose your EV using The Electric Car Scheme’s quote tool, you will have to input the following details which will give you an accurate idea of how much your car will cost to lease per month:

Annual salary,

Lease term,

Estimated mileage per year,

Salary sacrifice structure.

What Is The Impact Of a Salary Sacrifice Scheme On My Salary?

A salary sacrifice scheme works on the premise that you contractually agree to a reduced annual salary in return for a benefit - in this case, the use of an electric car.

You save on Income Tax and National Insurance by sacrificing your salary but you do incur a Benefit-in-Kind (BiK) tax, which is otherwise known as the ‘company car tax.’ The amount of BiK tax you pay depends on the value of the car. As announced in the 2024 Autumn Budget, the BIK rate will remain at 2% until 2025 and then will increase by 1% every year until 2028 when it will increase by 2% per year. By 2029-30 the BiK rate for EVs will be 9%. The BiK rates continue to strongly incentivise EV adoption, while rates for hybrid vehicles will be increased to align more closely with rates for petrol and diesel cars.

In this image, you can see how salary sacrifice affects your EV lease payments on a monthly basis. Without an EV salary sacrifice scheme in place, you will spend £390 on the cost of a MG4. However, with a scheme like The Electric Car Scheme, you can save £156 on Income Tax, £8 on National Insurance, taking your monthly lease cost down to £257 per month.

What Is Benefit-in-Kind Tax And Why Do I Need To Pay It?

Benefit-in-kind is a tax levied on the company benefits given to an employee, over and above their salary.

At The Electric Car Scheme, our company benefit is a heavily discounted electric car. From the HMRC’s perspective, this is different or supplementary to your gross salary, so you must pay BiK tax because you’re receiving an additional benefit.

It is easy to calculate how much BiK tax you owe by the following formula:

P11D value of the car * BiK rate * your income tax bracket = BiK tax owed.

Read our blog to learn more about Benefit-in-Kind. There, you'll find information on tax bands, comparisons between ICE vehicles and EVs, and more.

Who Is Eligible For An EV Salary Sacrifice Scheme?

If your employer is signed up to The Electric Car Scheme, typically everyone can access it (subject to the following):

Minimum age 21

Completion of 6 months’ service and outside of probation

Minimum salary of £20,000 after all salary sacrifice reductions

Full driving licence for a minimum of 6 months, with no more than 6 current endorsement points for all drivers of the vehicle

Entry to the scheme is ultimately at the employer’s discretion

Will I Need To Go Through A Credit Check?

As the car is leased through the company, the company will undergo a credit check. There is no personal credit check.

How Long Must I Commit To Entering Into The Salary Sacrifice Arrangement?

It is expected that your commitment is for the duration of the lease of the car (between 1 and 4 years). However, The Electric Car Scheme offers Complete Risk Protection that has been designed to support in any unexpected circumstances.

Complete Risk Protection provides reassurance that the employer is protected from day one, meaning if they have to make redundancies or dismiss an employee, they can do so without facing a fee. It also protects the employer from any shortfall due to employee resignation, long-term sickness, family-friendly leave and more! This differs from other market offerings which usually feature complex terms and conditions.

What Cars Are Available To Salary Sacrifice?

At The Electric Car Scheme, we work with the top leasing providers to ensure that you can get access to any electric car on the market. You can be confident that you will be able to achieve the best prices available as well as full tax savings on the cost of the car through salary sacrifice.

Explore our quote tool to find your dream EV and receive a personalised quote. This will give you a clear view of your monthly payments based on your lease terms and tax bracket.

Can I Choose Any Accessories And Colours?

Yes, you can choose any accessories and specify colours. However, it is important to bear in mind that these choices may impact cost and lead time as they may require a car to be built in the factory.

Can I Salary Sacrifice Two Cars On The Same Scheme?

Yes, you can get two cars on the same salary sacrifice scheme, but it is subject to the following:

The employee’s salary must not fall below the National Living Wage after the salary sacrifice deductions,

The employer must approve if an employee wishes to sacrifice their salary for more than one car.

You will also need authorisation from the electric car salary sacrifice provider.

The number of cars an employee can have on a salary sacrifice scheme is not limited by HMRC. It purely depends on the employer’s benefits frameworks and how much the employee earns!

Is It Possible To Lease A Used Or Second-Hand Car With Salary Sacrifice?

Yes, you can now salary sacrifice a used electric car from The Electric Car Scheme!

Usually, when a lease ends, the car goes back to the leasing company and is often sold at an auction. However, we wanted to do things differently. With our used car salary sacrifice scheme, electric cars that reach the end of their lease, or are returned early, are reconditioned and offered to members of The Electric Car Scheme at a discounted price.

Whether you choose a used or new car, the process will be the same. The Electric Car Scheme will provide the same package, support and service to you and your company.

The benefits of used electric car salary sacrifice include…

It is the most affordable way to lease an EV,

Available for quick delivery,

At The Electric Car Scheme, we have a wide range of used electric cars to choose from!

As shown in the example above, you can lease an Audi AQ e-tron Estate S Line, either new or used, through The Electric Car Scheme. If you opt for the new Audi, you'll save £210 in Income Tax and £84 in National Insurance, with a monthly payment of £795. However, by choosing the used Audi, your monthly payment drops to just £579 due to the lower original price. This is an excellent way to reduce your EV salary sacrifice payments each month.

What Happens If I Quit My Job While Using a Salary Sacrifice Scheme?

Most EV salary sacrifice schemes include early termination protection, as mentioned above. Return the vehicle without penalty if you're made redundant. If you resign, you'll typically need to pay an early termination fee or transfer the lease to a personal agreement. Check your specific scheme's terms before signing.

Can I Claim A Mileage Allowance With A Salary Sacrifice EV?

Yes, claim HMRC's approved 5p per mile for business travel in electric vehicles. This covers electricity costs only. Keep accurate records of business journeys. Your employer may offer a different rate, so you should always check your company's policy.

How Does Salary Sacrifice Affect My Pension Contributions?

Pension contributions are calculated on your reduced salary after sacrifice. This may reduce your pension payments slightly, so you should consider increasing your pension contributions to maintain the same level. Some employers adjust their contributions to offset this impact.

What’s The Difference Between Salary Sacrifice And A Personal Car Lease?

Salary sacrifice offers tax savings through reduced Income Tax and National Insurance. Personal leases require full payments from post-tax income. Salary sacrifice includes insurance and maintenance. Personal leases often require separate arrangements for these services.

How Does Charging Work With A Salary Sacrifice EV?

Home charging costs are your responsibility. Many schemes offer discounted home charger installation. Some include free public charging network memberships. Check if your employer offers workplace charging - this is usually free or heavily subsidised.

With The Electric Car Scheme’s brand new offering, The Charge Scheme, employees can now salary sacrifice their EV charging everywhere - whether on the go, at home or work. It means you can now save between 20-50% on the cost of charging, which can be expensive if you predominantly charge publicly!

What Happens If I Go On Maternity/Paternity Leave?

Most EV salary sacrifice schemes allow you to continue the salary sacrifice agreement during parental leave. Payments are adjusted to match your reduced income. Some employers offer payment holidays or reduced payments during this period. Confirm specific arrangements with your HR department.

How Does Salary Sacrifice Impact My Mortgage Application?

Lenders consider your reduced salary figure. This may affect how much you can borrow. You will need to provide documentation showing the salary sacrifice arrangement to your mortgage advisor. Some lenders make allowances for salary sacrifice schemes when calculating affordability.

What Delivery Time Frame Should I Expect For My Salary Sacrifice EV?

A new EV will typically take 3-6 months for delivery. Some popular models may have longer waiting times. Pre-configured or in-stock vehicles deliver faster. Used EVs are often available for immediate delivery, which is a huge selling point if you need a car as soon as possible.

Can I Switch To A Different EV During My Salary Sacrifice Term?

Mid-contract changes usually aren't permitted. Early termination fees apply if you want to switch vehicles. If you are interested in potentially switching your car after a year or two, you should consider shorter terms when signing up to a salary sacrifice scheme. Some schemes offer flexibility after minimum terms (usually 12 months).

Common Employer Questions

Implementing any employee benefit at your company is a big decision and with that comes lots of questions. We have compiled two of the most common questions employers ask about the scheme.

Is There A Lot Of Admin With A Salary Sacrifice Scheme?

Surprisingly, there isn’t a lot of admin involved in setting up and rolling out a salary sacrifice scheme. We aim to make the process as hassle-free as possible. At The Electric Car Scheme, we have an automated monthly payroll, HMRC and climate reporting to help you with compliance and keep your HR, Finance and Tax affairs on track.

You will also have a dedicated Customer Success Manager throughout the process who will be on hand to support and answer any questions you may have regarding the scheme, they will help you from your launch day!

How Does Salary Sacrifice Compare To Other EV Schemes Available?

Salary sacrifice offers the biggest tax savings. Company car schemes have similar benefits but less flexibility. PCP requires higher monthly payments from post-tax income. Salary sacrifice includes insurance and maintenance, unlike most PCP deals.

There are many benefits to implementing a green car scheme like The Electric Car Scheme, for both employees and employers.

Employee benefits include:

Save 20-50% on any electric car through salary sacrifice,

EV salary sacrifice makes it easy to access government tax incentives and save money on electric cars,

Drive down your CO2 emissions by driving electric,

Sustainability has become affordable and stress-free to implement!

Employer benefits include:

Complete Risk Protection designed to protect employers,

No net cost to your business to run the scheme,

Boost employee retention,

At The Electric Car Scheme, we search across the EV market to find the best prices,

Show your team you care and make them feel rewarded,

Simple to use reporting to make life easier for HR and Finance teams.

Learn more about the scheme by visiting our website and implementing the scheme today!

Last updated: 10.12.24

Our pricing is based on data collected from The Electric Car Scheme quote tool. All final pricing is inclusive of VAT. All prices above are based on the following lease terms; 10,000 miles pa, 36 months, and are inclusive of Maintenance and Breakdown Cover. The Electric Car Scheme’s terms and conditions apply. All deals are subject to credit approval and availability. All deals are subject to excess mileage and damage charges. Prices are calculated based on the following tax saving assumptions; England & Wales, 40% tax rate. The above prices were calculated using a flat payment profile. The Electric Car Scheme Limited provides services for the administration of your salary sacrifice employee benefits. The Electric Car Scheme Holdings Limited is a member of the BVRLA (10608), is authorised and regulated by the FCA under FRN 968270, is an Appointed Representative of Marshall Management Services Ltd under FRN 667174, and is a credit broker and not a lender or insurance provider.